- 1.Brand Landscape

- 2.Vehicle Segment Landscape

- 3.Energy Preference

- 4.Price Range Penetration

- 5.Search Analysis for Chinese Cars

- 6.Conclusion

As one of the largest automotive consumer markets in the Middle East, Saudi Arabia is experiencing a significant industry transformation.

According to the February 2025 Saudi Automotive Market Report by Cartea Research Institute (automotive lifestyle service platform for Arabic-speaking countries, offering local users with professional car news, accurate car-buying information, and comprehensive vehicle services), Japanese and Korean brands collectively hold a market share exceeding 50%. Toyota and Hyundai continue to lead in sales rankings. Meanwhile, the emergence of new players is gradually reshaping the competitive landscape. In contrast, the top five Chinese brands together account for only 5.3%, highlighting the challenging path ahead for greater penetration.

In a market environment dominated by fuel-powered vehicles (representing 93.3% of sales), increasing family-oriented demand, and growing consumer interest in intelligent features, how can Chinese car manufacturers break through the dominance of Japanese and Korean brands? How can they address Saudi consumers’ core demands for economical sedans, seven-seater SUVs, and localized services?

This article analyzes market trends from multiple perspectives—including market structure, price segments, and user search behavior— to provide key strategic insights for Chinese brands aiming to gain a competitive foothold.

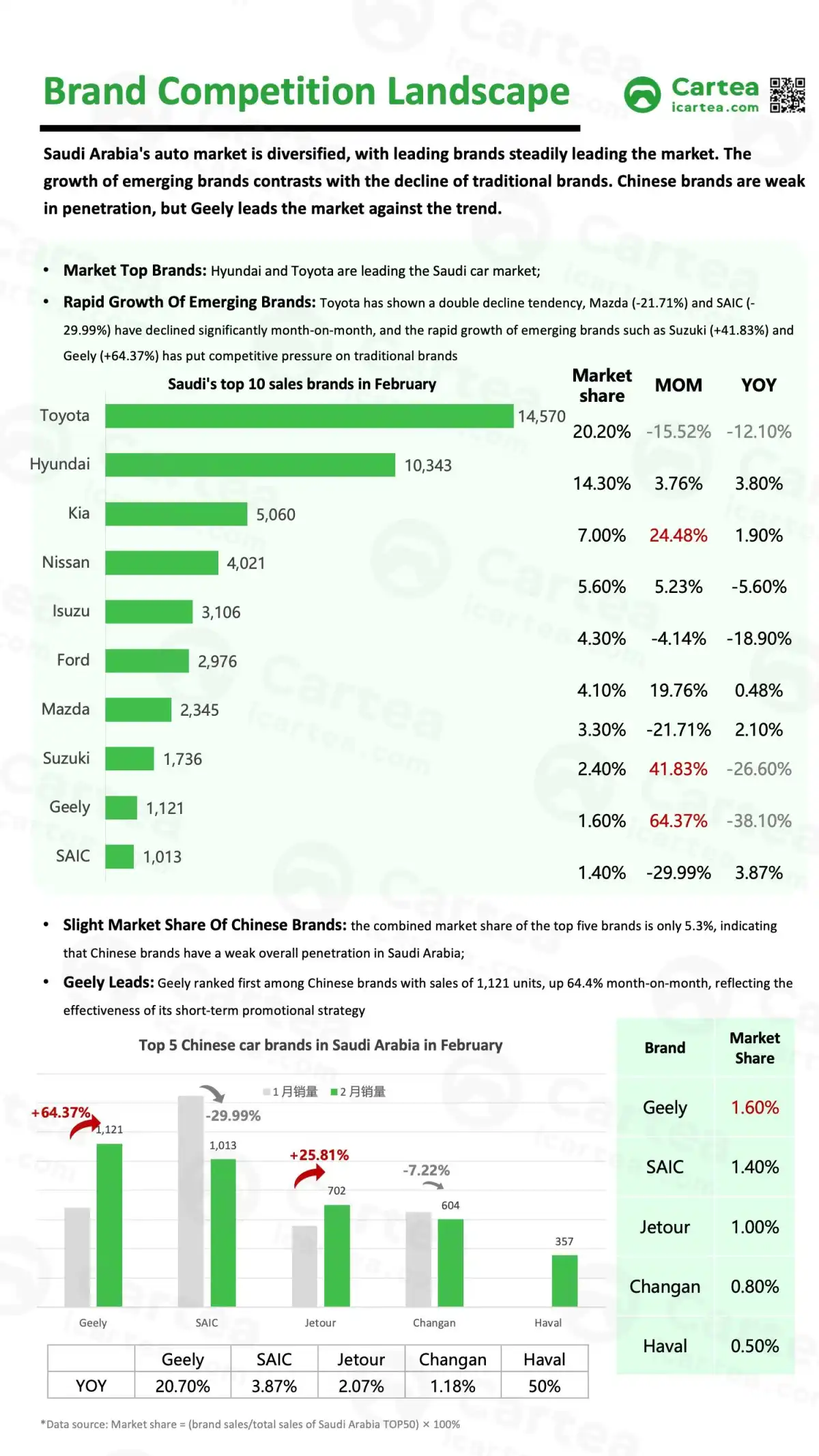

1.Brand Landscape

The Saudi automotive market currently displays a “tripolar” brand structure—established leaders maintaining dominance, emerging players rising swiftly, and Chinese brands gradually gaining a foothold.

Stable Dominance of Japanese and Korean Brands

As of February 2025, the top five best-selling automotive brands in Saudi Arabia were all from Japan and South Korea. Toyota led the rankings with 14,570 units sold, and a capturing a 20.20% market share. Hyundai followed closely with 10,343 units sold, capturing a 14.30% market share. Together, these two automakers alone accounted for more than one-third of the total market, underscoring their deep-rooted presence and strong brand loyalty among Saudi consumers.

Rapid Growth of Emerging Brands

Emerging brands are expanding rapidly and presenting a tangible challenge to the traditional giants. Among the top ten brands in February 2025, three showed month-over-month growth rates exceeding 20%: Kia (7.0% market share, 24.48% MoM growth), Suzuki (2.40% market share, 41.83% MoM growth), and Geely (1.60% market share, 64.37% MoM growth). In contrast, Toyota experienced a significant 15.52% decline in monthly sales during the same period.

Weak Competitive Position of Chinese Brands

In February 2025, the top five Chinese automotive brands held a combined market share of just 5.3%, highlighting their relatively weak position in the Saudi market and the substantial opportunity for growth. Geely was the best-performing Chinese brand, selling 1,121 units and securing a 1.60% market share, ranking ninth overall. SAIC followed with 1,013 units sold and a 1.40% market share. Jetour, Changan, and Haval rounded out the top five Chinese brands.

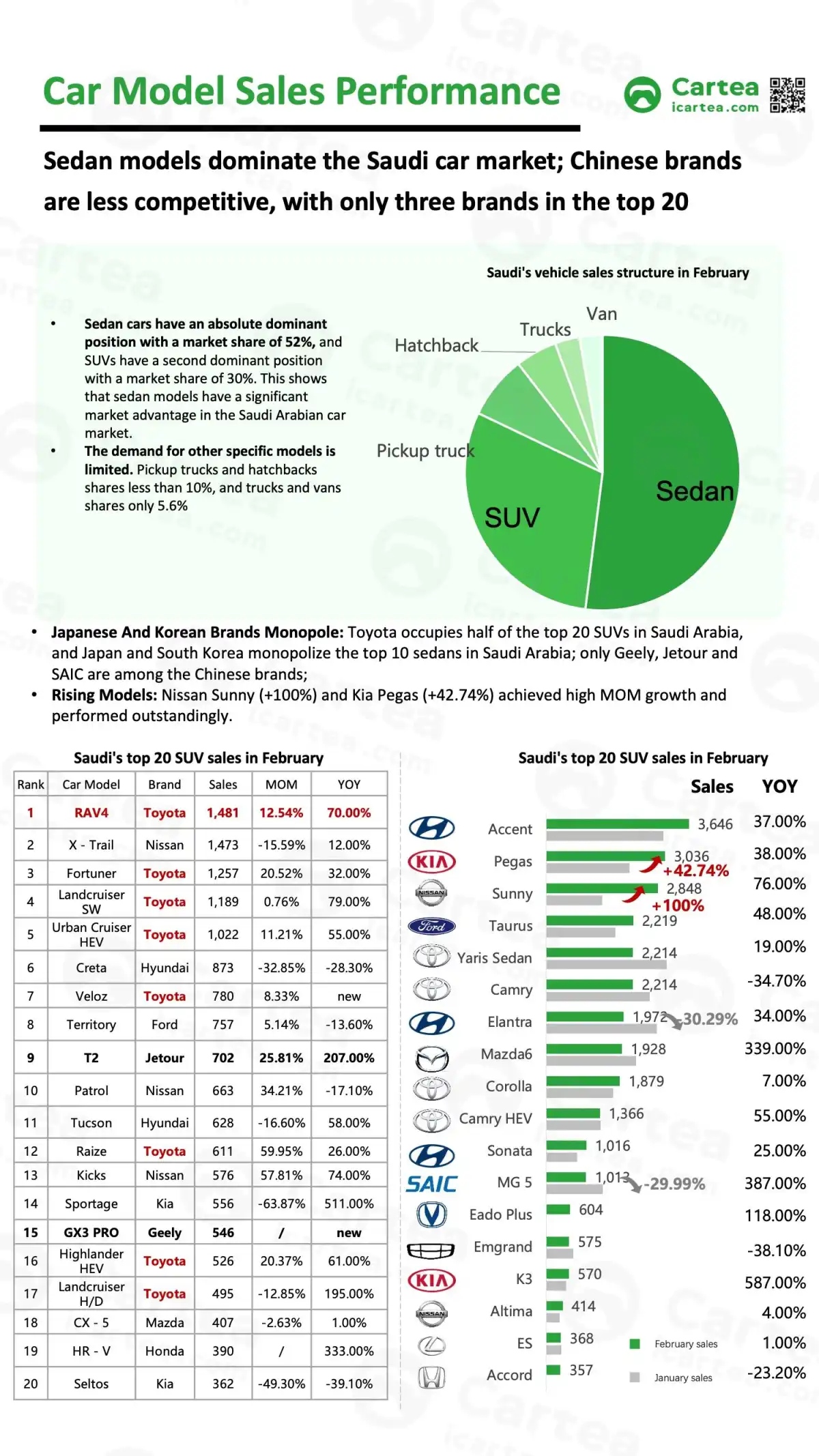

2.Vehicle Segment Landscape

In February 2025, sedans accounted for over 50% of total vehicle sales in Saudi Arabia, while SUVs captured more than 30%. Japanese and Korean models remained dominant in both categories, whereas Chinese vehicles continued to struggle in attracting significant consumer interest.

Vehicle Body Types

The Saudi market is predominantly composed of sedans and SUVs, while pickups and hatchbacks occupy niche segments. According to February 2025 data, sedans held a 52% market share, SUVs 30%, pickups 7%, and hatchbacks just 5%.

Top 20 Best-Selling Sedans

Japanese and Korean models dominate the sedan market. In February 2025, all top 3 best-selling sedans were from Japan or South Korea. Nine of the top 10 and 14 of the top 20 models also came from these two regions, covering a wide range from compact to mid-to-large vehicles and firmly establishing themselves as the mainstream choice across segments.

Korean sedans outperformed their Japanese counterparts. The Hyundai Accent and Kia Pegas were the only two models to exceed 3,000 units in monthly sales, breaking Toyota’s previous dominance in the entry-level sedan segment (with the Corolla and Yaris). In the midsize sedan category, the Toyota Camry remained a top choice for Saudi consumers, though its lead over the Hyundai Sonata was narrowing. The Camry’s status was notably challenged by the Ford Taurus, whose sales dropped sharply both year-over-year and month-over-month.

Chinese Compact Sedans Show Some Promise

Only three Chinese sedans made it into the top 20 in February 2025, all of which were compact cars: the SAIC MG 5, Changan Eado PLUS, and Geely Emgrand. The MG 5 stood out due to MG’s strong overseas brand presence, making it the only Chinese model to exceed 1,000 units in monthly sales. The Eado PLUS and Emgrand gained traction supported by through their “low price, high configuration” positioning, challenging Japanese and Korean competitors in the value segment.

Top 20 Best-Selling SUVs

Toyota dominates the Saudi SUV market. According to February 2025 data, Toyota led in nearly every SUV category—from compact to full-size and from urban to off-road models. Eight Toyota SUVs ranked in the top 20, including four in the top five. High-end models like the iconic Land Cruiser further reinforce Toyota’s exceptional brand influence.

Jetour T2 Stands Out Among Chinese SUVs

The Jetour T2 performed notably well among Chinese SUV offerings, selling 702 units in February 2025. Given the Middle East’s strong off-road culture, the T2 stood out with its electrified powertrain optimized for outdoor and camping experiences. Its modern design, intelligent features, and competitive pricing resonated with young consumers.

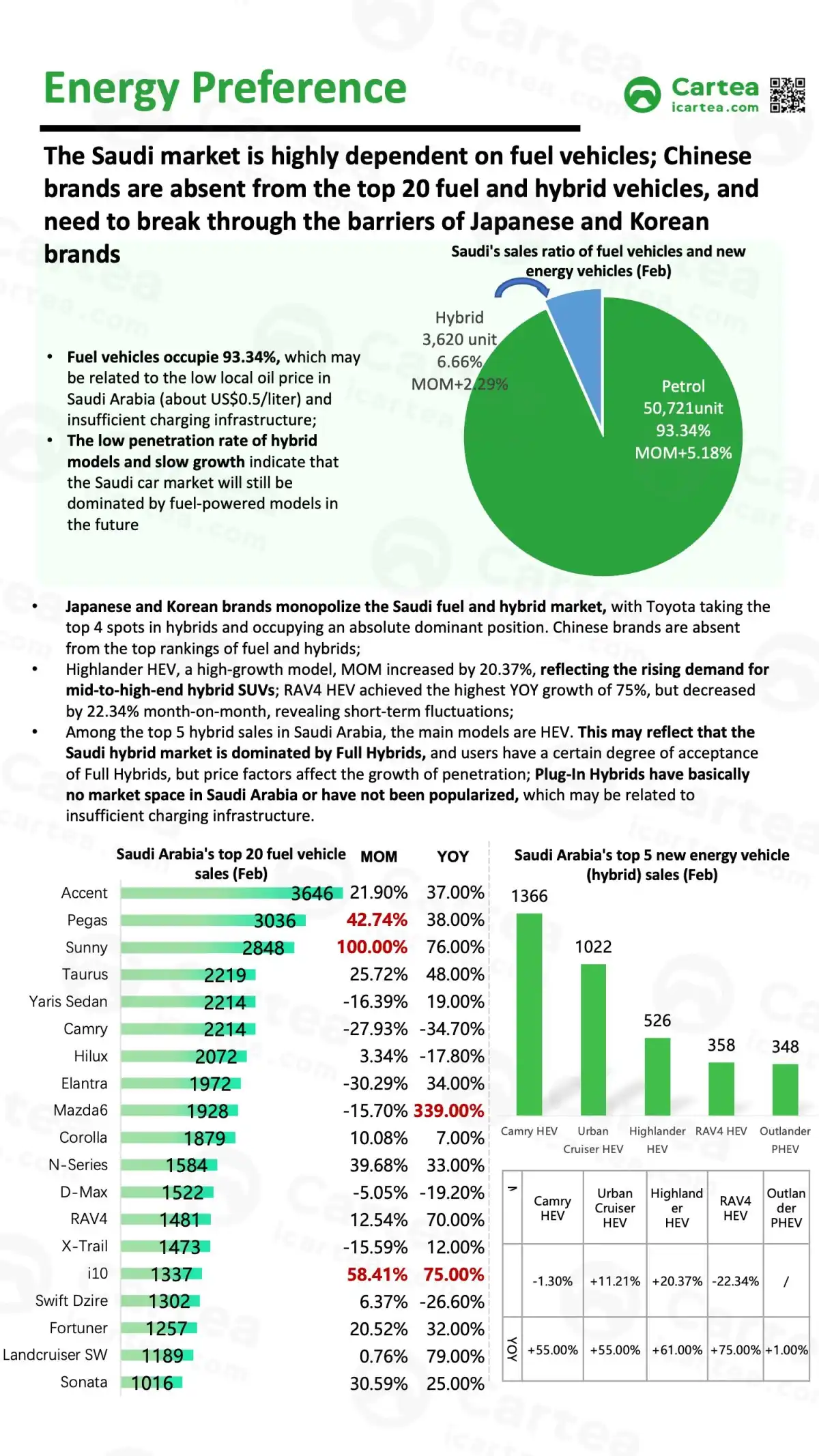

3.Energy Preference

The Saudi automotive market remains overwhelmingly dominated by internal combustion engine (ICE) vehicles. Hybrid electric vehicles (HEVs) hold only a small share, while new energy vehicles (NEVs) have only just begun to penetrate the market.

ICE Vehicles Account for Over 90% of Sales

As of February 2025, ICE vehicles accounted for a staggering 93.34% of total vehicle sales in Saudi Arabia. As a globally recognized oil-producing nation, Saudi Arabia benefits from extremely low fuel prices—approximately $0.50 per liter—which makes fuel efficiency a low priority for most consumers. Affordable, reliable, and durable ICE vehicles remain the preferred choice for Saudi drivers.

HEVs Dominate Among Hybrids

Hybrid vehicles accounted for just 6.66% of total sales in February 2025, with the vast majority being HEVs from Japanese and Korean brands. Plug-in hybrid electric vehicles (PHEVs) captured only a minimal share. While traditional hybrids have gained modest traction, PHEVs remain in the early stages of market adoption. The limited availability of PHEV models, combined with consumer unfamiliarity with their advantages and Saudi Arabia’s underdeveloped charging infrastructure, continue to hinder broader adoprtion.

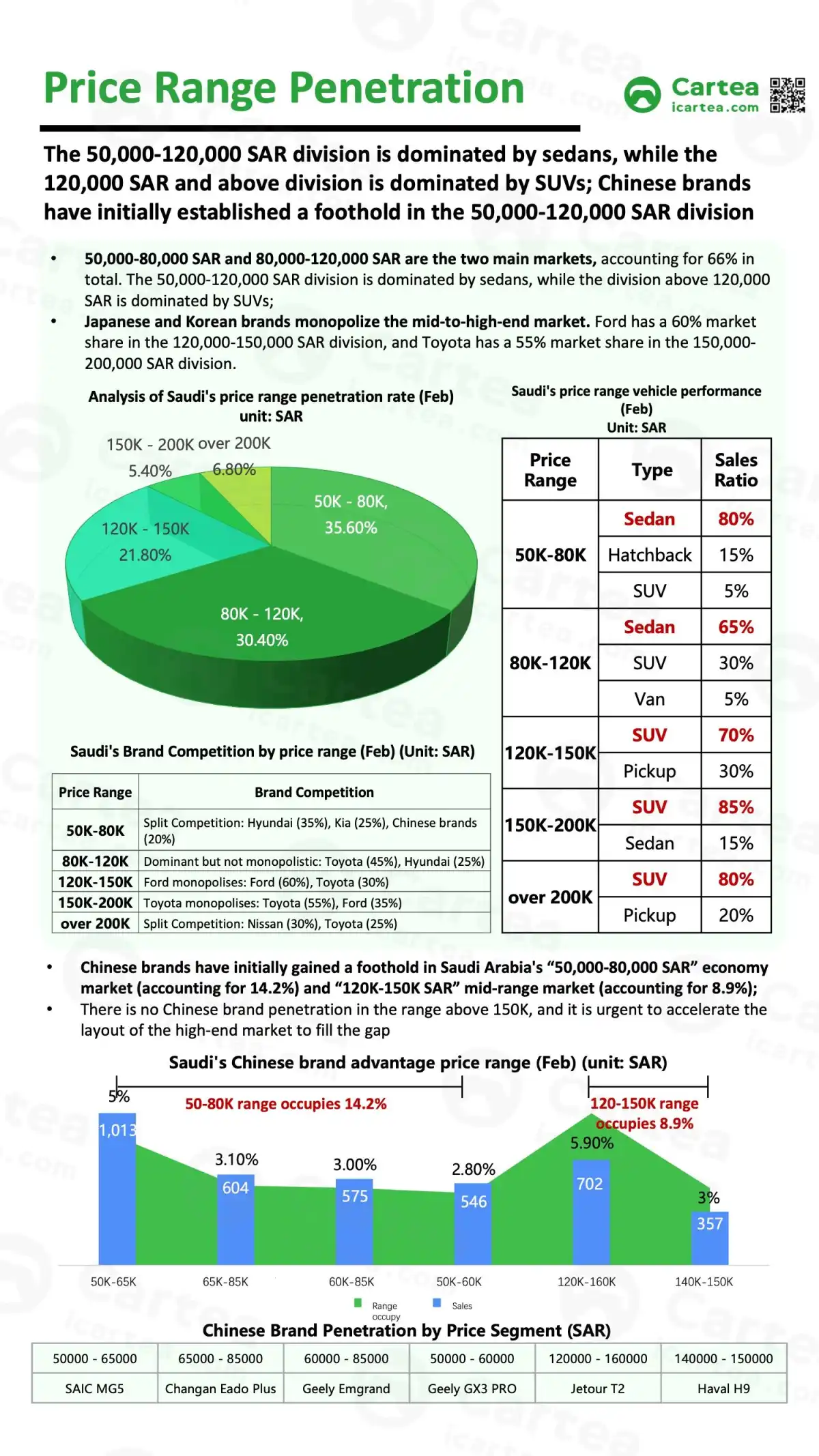

4.Price Range Penetration

In Saudi Arabia, sedans dominate the SAR 50,000–120,000 range, while SUVs are prevalent above SAR 120,000. Chinese brands have begun to establish a foothold in the SAR 50,000–120,000 segment but remain absent from the premium market.

Overall Market Analysis

Vehicles Under SAR 120,000 Dominate, Primarily Sedans

As of February 2025, vehicles priced under SAR 120,000 accounted for two-thirds of total sales. Specifically, models priced between SAR 50,000–80,000 represented 35.6% of sales (with sedans making up 80% of this range), while those between SAR 80,000–120,000 held a 30.4% share (65% sedans). This highlights the strong potential of the entry-level sedan market—affordable pricing is the key to high sales volumes.

Intense Competition in the SAR 120,000–150,000 Range

Vehicles in this price bracket accounted for 21.8% of sales. Ford disrupted the long-standing dominance of Japanese and Korean brands in this segment with strong performances from the Taurus and Territory, capturing a combined 60% market share in this range.

SUVs Dominate the Mid-to-High-End Market (Above SAR 150,000)

Saudi consumers prioritize family travel, driving strong demand for large 7-seater SUVs such as the Toyota Highlander.

Off-road culture is highly influential, so the high-end market is largely occupied by rugged SUVs and pickups, such as the Toyota Land Cruiser and Nissan Patrol.

The executive sedan segment is relatively small, with the Lexus ES being the only standout performer.

Chinese Brands Analysis

Chinese brands have made initial inroads into the SAR 50,000–80,000 budget segment (14.2% market share) and the SAR 120,000–150,000 mid-range segment (8.9% share).

However, Chinese brands remain absent from the premium segment above SAR 150,000, highlighting an urgent need to accelerate development in the premium segment and close this market gap.

5.Search Analysis for Chinese Cars

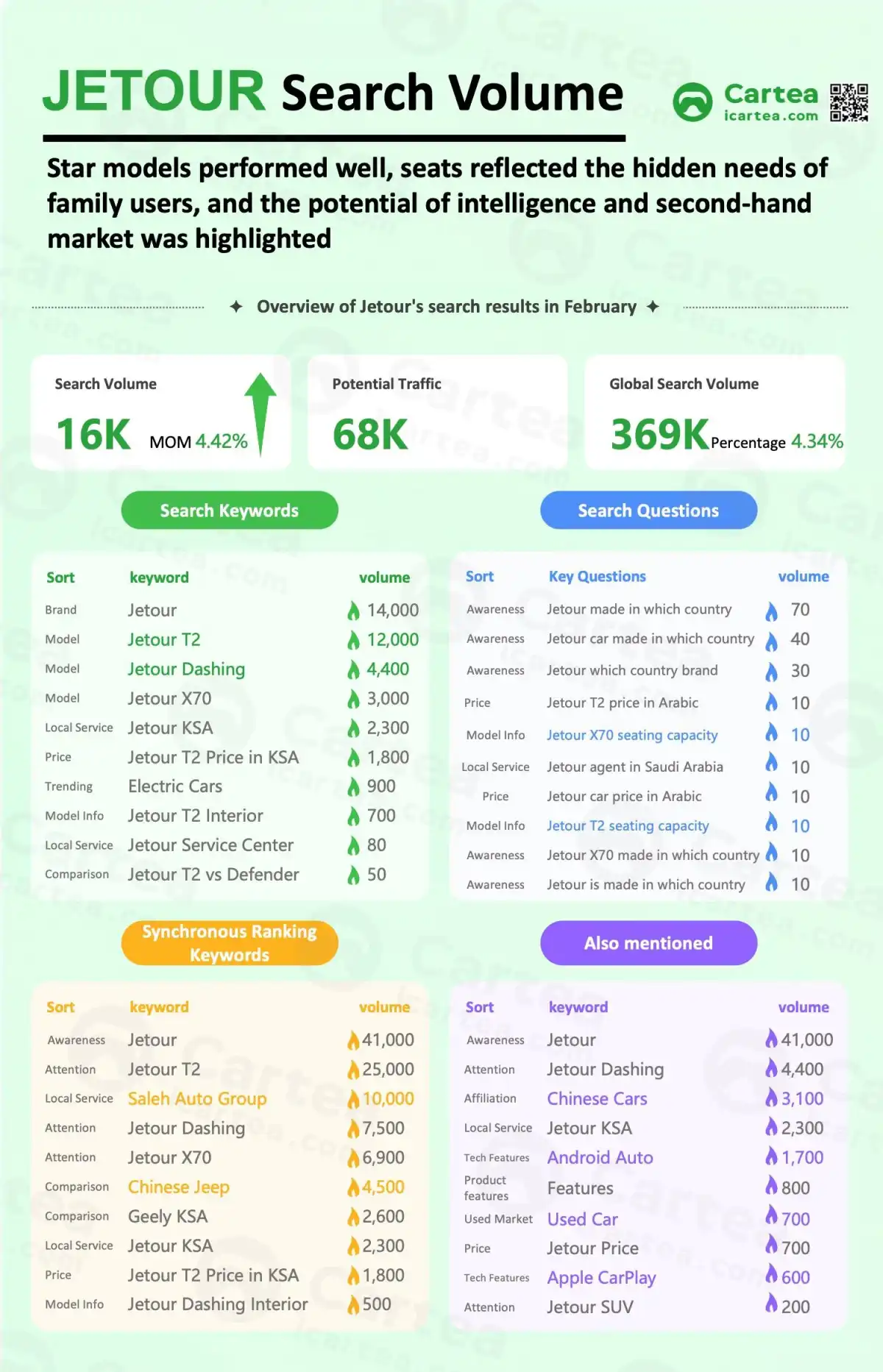

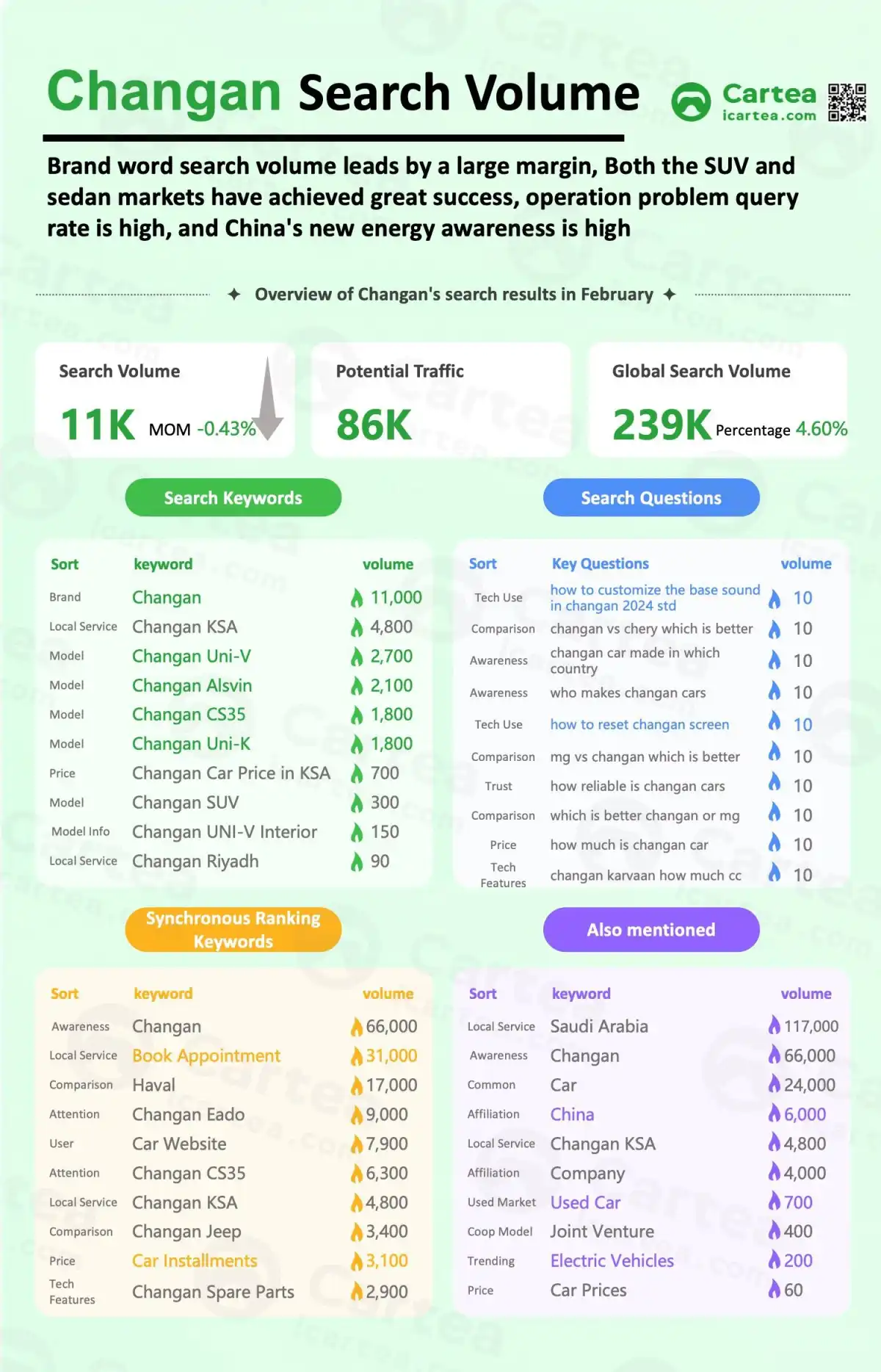

Jetour led with 15,959 searches, likely driven by a recent model launch and reflecting the positive impact of intensified local marketing efforts. Meanwhile, Changan topped in potential traffic volume with 86,000 visits, indicating the effectiveness of its localized product lineup and marketing strategy in Saudi Arabia.

Key Observations:

Strong Interest in Smart Features

Local users demonstrate a clear interest in the intelligent configurations of Chinese vehicles. Many search queries relate to how to use specific functions, especially those within the infotainment system.

High Demand for Family-Oriented Vehicles and 7-Seater SUVs

Family vehicles, particularly 7-seat SUVs, have strong appeal in the Saudi market, aligning with local lifestyle needs.

High Price Sensitivity Among Potential Buyers

Prospective Chinese car buyers are highly price-sensitive. Their purchasing decisions are significantly influenced by factors such as:

Availability of attractive financing offers

Resale value of the vehicle

Convenience of regional service support

Reliability of local dealerships

These insights emphasize the importance of not just competitive pricing, but also a well-rounded ownership experience to build trust and drive conversions.

Top 5 Chinese Brands by Search Volume: Insight Analysis

1. Jetour

SUV-Centric Lineup:

Model-related keywords (T2, Dashing, X70) account for 68% of the brand’s total searches. T2 and Dashing emerging as key traffic drivers. Users showed strong interest in terms like “desert durability” and “luxury configurations,” indicating a need for scenario-based content. Seat-related searches reveal a latent demand for 7-seat layouts from family users.

Smart Features as a Differentiator:

High search volumes for Android Auto and Apple CarPlay suggest that “smart connectivity demos” could be a valuable marketing hook.

Trust and Use-Case Penetration Needed:

Searches frequently associate Jetour with local dealership groups, used cars, and the broader “Chinese car” category. A dual strategy is recommended: address user pain points (used cars/family needs) while reinforcing brand trust(highlighting dealer reliability and Chinese automotive quality).

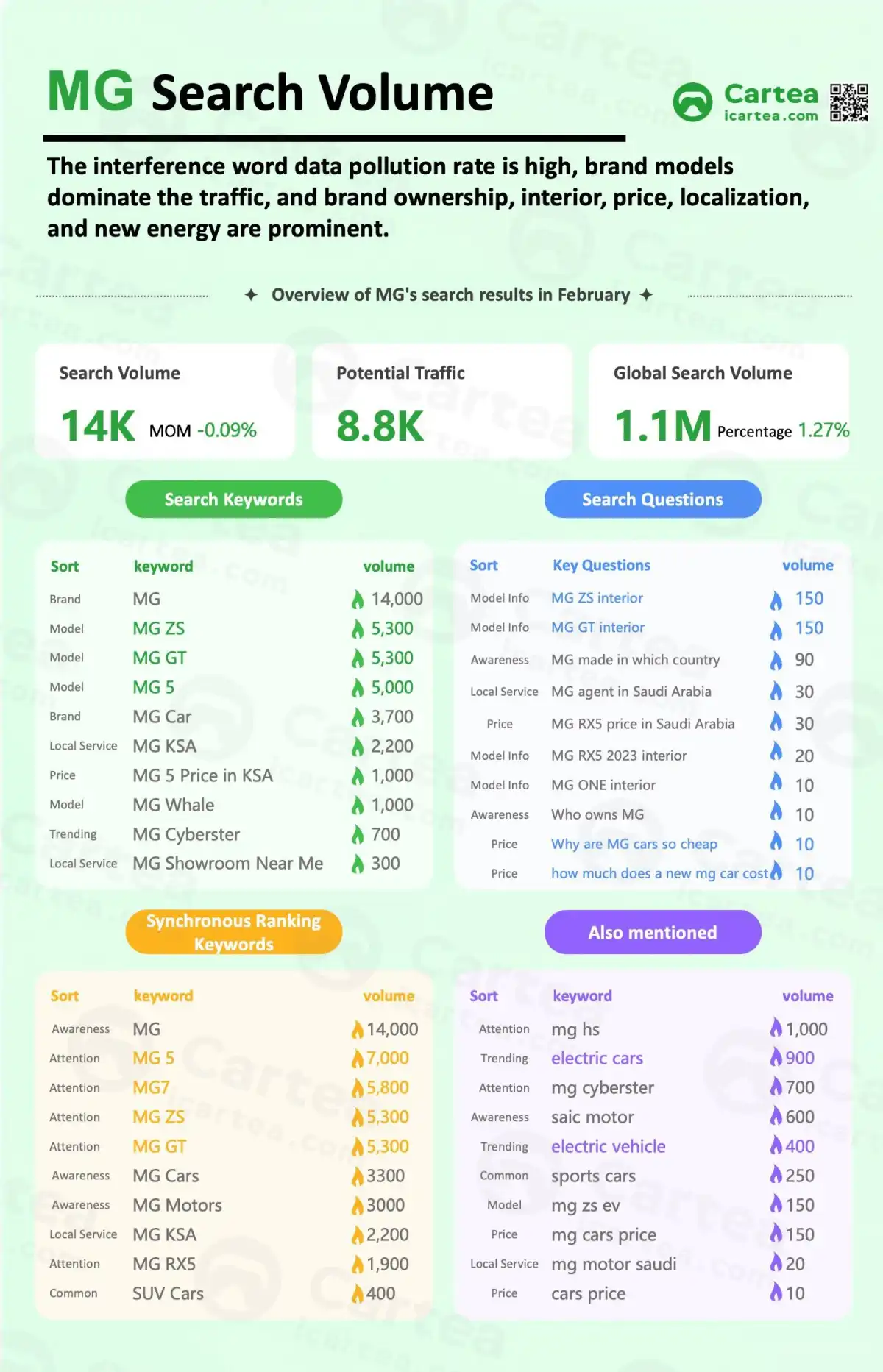

2. MG

Model-Driven Interest:

Keywords like MG ZS, GT, 5, and 7 account for 76% of total search traffic.

Around 60% of brand searches focus on brand identity (e.g., country of origin, ownership) and product details (e.g., interior design), reflecting strong user interest in both heritage and vehicle refinement.

3. Changan

Strong Brand Awareness:

The keyword “Changan” ranks prominently in brand-related search volume. UNI-V and Eado dominate the sedan segment, while CS35 and UNI-K cover SUVs, suggesting the need for differentiated segment marketing.

High Demand for Service and Financing:

Frequent searches related to operations (e.g., sound settings, infotainment restarts) reveal deep engagement with vehicle features. Queries about service appointments and installment plans show a clear need for convenience and payment flexibility.

Potential in New Energy Vehicles (NEVs):

High association with keywords like used cars, Chinese cars, and electric vehicles. Changan enjoys relatively high trust among Saudi users compared to other Chinese brands.

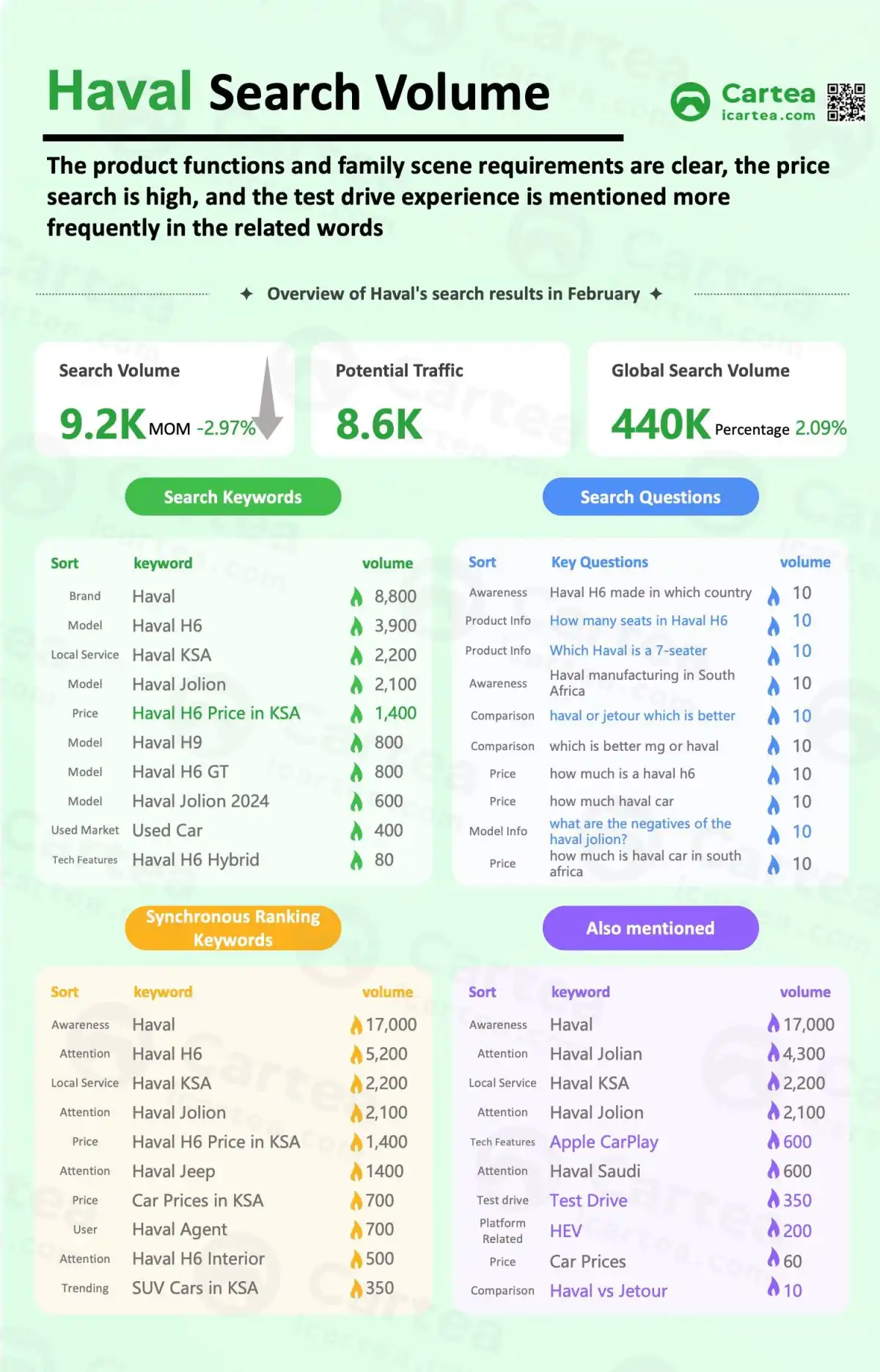

4. Haval

Functional and Family-Oriented Needs:

Searches like “number of seats,” “7-seat models,” and “interior” reflect strong demand for practical, family-friendly vehicles. Haval effectively targets both young consumers and family SUV buyers.

High Price Sensitivity:

Price-related queries are significantly above the industry average (12%), indicating concern around cost and affordability.

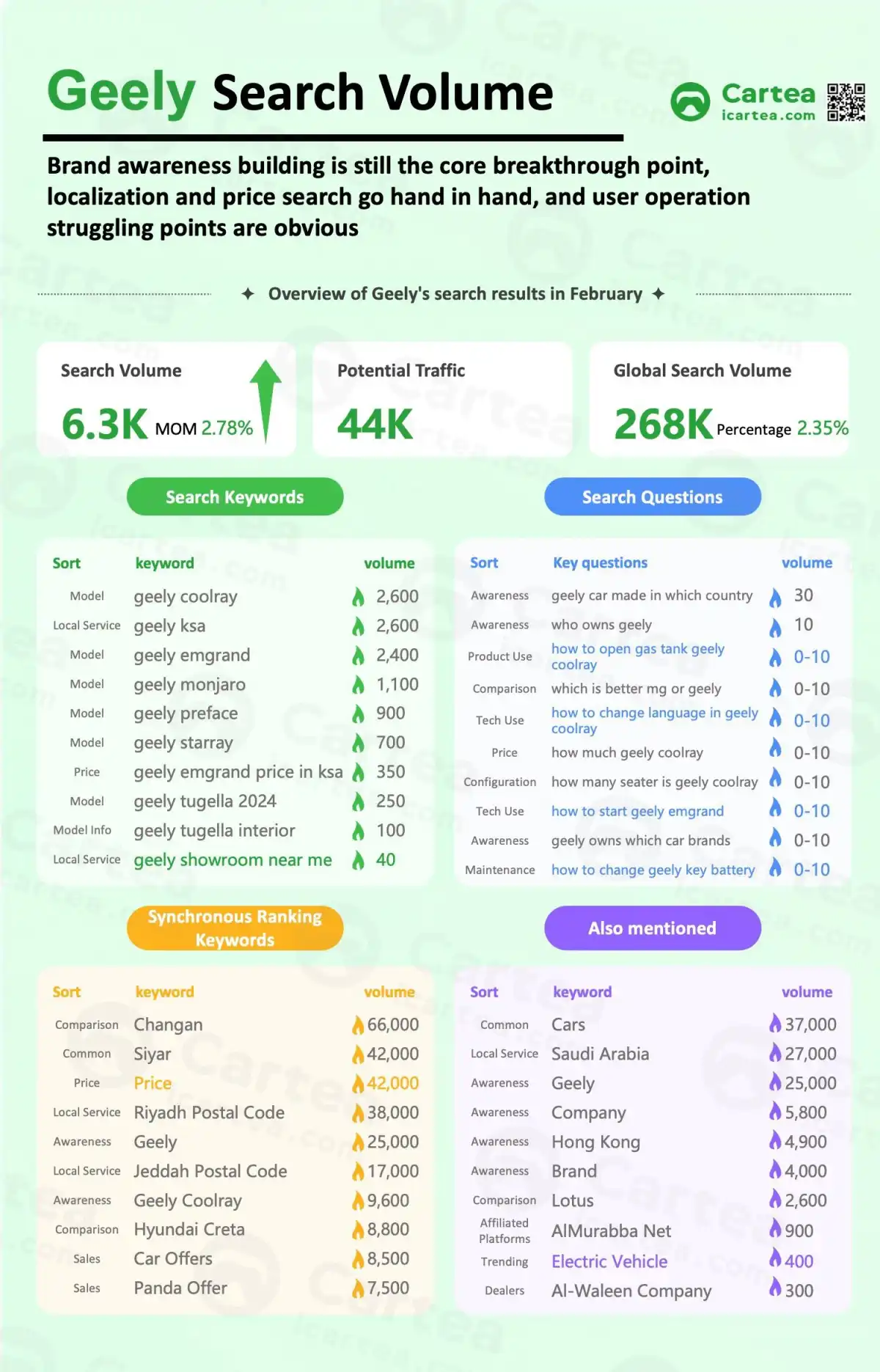

5. Geely

Concentrated Brand Focus:

Coolray and Emgrand make up 47% of total searches, indicating that user perception is anchored in compact SUVs and sedans. Users are highly interested in the brand’s origin and corporate reputation.

Emphasis on Localization and Pricing:

Localization-related searches (e.g., service areas, dealer locations) exceed 30%, showing strong demand for accessible services. Price-related queries outnumber technical ones by 3.5 times, indicating users are focused on value comparison after product research.

User Onboarding Pain Points:

Frequent queries like how to open the fuel tank, language settings, and how to start the vehicle suggest an education gap. Creating Arabic-language tutorial videos is highly recommended.

6.Conclusion

Based on sales and search data analysis, Cartea provides a comprehensive interpretation of the Saudi automotive market from three core dimensions: brand structure, energy preference, and vehicle type demand.

Brand Structure: Japanese and Korean Brands Dominate; Chinese Brands Yet to Enter the Premium Market

Sales data shows that Toyota and Hyundai together account for over one-third of the market. Saudi consumers place strong trust in established Japanese and Korean brands and their leading dealerships, favoring vehicles that have proven reliability and brand recognition. These brands also offer convenient and dependable after-sales services, making them a safer choice in the eyes of many buyers. This preference poses a major challenge for newer Chinese brands trying to gain a foothold.

While Chinese brands hold only a 5.3% market share, they have made notable inroads in the SAR 50,000–150,000 segment, especially with compact sedans that perform well in terms of value. Their “high spec for low price” strategy has attracted younger buyers and opened the door to the compact segment. However, breaking into the premium market remains a major hurdle.

Energy Preference: ICE Still Dominates; NEV Penetration Remains Extremely Low

Due to Saudi Arabia’s extremely low fuel prices, the cost advantages of new energy vehicles (NEVs) are not compelling. The market also suffers from a limited selection of NEVs, and consumer awareness and exposure to such models are low. Furthermore, the public charging infrastructure is underdeveloped, making it difficult for users without home charging to enjoy a smooth ownership experience. This has effectively “discouraged” many potential NEV buyers.

Vehicle Type Preference:

Sedans – 52% Penetration, Dominated by Budget Models (SAR 50,000–120,000)

With a large population of foreign laborers in Saudi Arabia, demand is strong for affordable vehicles with good resale value. Entry-level sedans within the SAR 50,000–120,000 range align well with their budget and needs. Buyers with more financial flexibility tend not to choose sedans—especially mid-size and larger models—resulting in very limited demand for executive sedans.

SUVs – 30% Penetration, Popular in the SAR 120,000+ Segment

Saudi households tend to be large, and SUV models offer greater seating and cargo space, ideal for family travel. Moreover, given the country’s harsh terrain and climate, users require vehicles with high ground clearance and four-wheel-drive capability. SUVs are better suited than sedans for such conditions, making them more attractive to local consumers.

Strong Preference for Rugged Off-Road SUVs

Off-roading is deeply rooted in Middle Eastern culture, with many clubs and events focused on dune bashing and exploration. Rugged and durable SUVs are highly valued, and premium sales are concentrated in hardcore off-road SUVs and pickups, such as the Toyota Land Cruiser and Nissan Patrol. The executive sedan segment is very limited, with the Lexus ES being a rare exception in terms of popularity.