- Understanding Car Insurance Excess

- How Excess Amounts Work on Your Policy

- Factors Influencing Your Car Excess Cost

- Managing Your Excess:Key Considerations

- FAQ

What is excess in car insurance? It's the first amount you pay if your car gets damaged, before your insurer steps in. Understand how this key cost affects your wallet.

Understanding Car Insurance Excess

When you have car insurance, 'excess' is a very important term to know. It's also called a 'deductible' in some places. This is the part of the repair bill you agree to pay yourself when you make a claim. For example, if your car needs repairs costing AED 5,000 / SAR 5,000 and your excess is AED 1,000 / SAR 1,000, you pay the first AED 1,000 / SAR 1,000. Your insurance company then pays the leftover AED 4,000 / SAR 4,000, up to the total limit of your car insurance cover. This system helps share the financial risk between you and your insurer.

Why Insurance Policies Have Excess

Why do car insurance policies include an excess? There are several good reasons for this common practice:

Shared Cost Responsibility:The excess ensures you have some financial stake in every claim. It discourages people from making claims for very small scratches or dents, which helps keep overall insurance costs down. It means you share the financial risk for any vehicle damage.

Lower Premiums:This is a direct benefit for you. If you agree to pay a larger amount as your excess when you claim, your insurance company sees you as less of a risk. Because of this, they might offer you a lower annual car insurance premium. On the flip side, if you want a very low excess, your premiums will likely be higher.

Deductible System:You can think of the excess as your first contribution to the repair costs. It's like you are a partner in the repair of your vehicle. Remember, this excess applies freshly for each separate claim event you make on your car insurance policy.

How Excess Amounts Work on Your Policy

When you look at your car insurance policy, you'll see that your total excess cost usually has two main parts. Understanding these parts is key to managing your insurance expenses and your potential out-of-pocket costs after an accident.

Compulsory Excess:This is a fixed, required amount set by your car insurance company. You cannot change this part. Insurers determine this amount based on various details about you and your vehicle. For instance, younger drivers or those with less driving experience might face a higher compulsory excess. The type of car you drive, especially if it's a high-performance or very valuable vehicle, can also increase this mandatory amount.

Voluntary Excess:This is the extra amount you willingly choose to add on top of the compulsory excess. This is where you have some control. If you pick a higher voluntary excess, your annual insurance premium will typically go down. This is because you are agreeing to take on more of the financial risk upfront. It's a way to save money on your policy's monthly or yearly payments, but it means you'll pay more if you need to make a claim. For example, if your compulsory excess is AED 500 / SAR 500 and you choose a voluntary excess of AED 1,500 / SAR 1,500, your total excess for a claim will be AED 2,000 / SAR 2,000.

Types of Coverage Where Excess Applies

It's important to know when an excess applies to your car insurance claim. Generally, the excess comes into play when there's damage to your own vehicle. Here are the main types of car insurance cover where you'll typically pay an excess:

Comprehensive Insurance:This is the broadest type of car insurance. It covers damage to your vehicle from many events, like accidents, theft, fire, or even natural disasters. It also covers damage you might cause to other vehicles or property. When you claim for damage to your own car under a comprehensive policy, your excess will apply.

Collision Coverage:This specific part of your car insurance policy focuses on damage to your vehicle resulting from a collision with another car, an object, or even if your car rolls over. If you make a claim for collision-related damage, you will pay your excess before your insurer covers the rest.

Please remember an important rule about car insurance excess:

Third-Party Liability Claims:Excess usually does not apply when you are responsible for an accident and someone else claims against your policy for damage to their car or property. Your policy's 'third-party liability' section handles this. You won't pay an excess in this situation, but causing an accident might affect your future car insurance premiums.

Factors Influencing Your Car Excess Cost

The total excess amount you might need to pay on your car insurance policy is not random. It's influenced by several different factors. These factors help insurance companies assess the risk involved with insuring your vehicle.

Policyholder Details:Your personal details play a big part. For instance, young and inexperienced drivers are often seen as a higher risk. Because of this, insurance companies typically set a higher compulsory excess for them. This same rule can apply to drivers who have recently received their license.

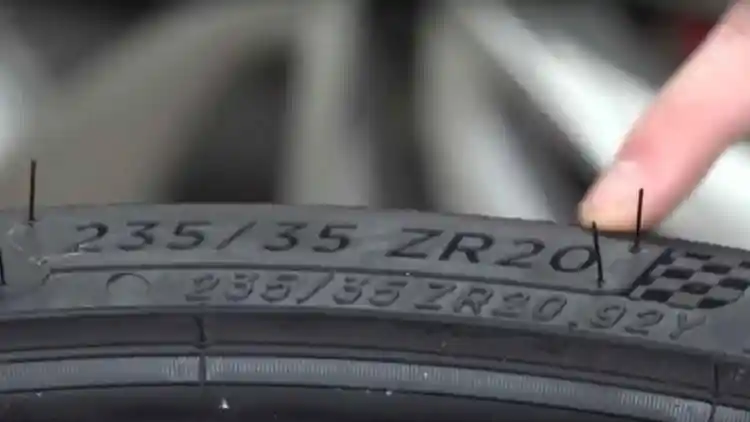

Vehicle Type:The kind of car you drive also affects your excess fees. If you own a high-value car, a powerful sports car, or a vehicle that is very expensive to repair, your excess will likely be higher. This is because the potential repair costs for such vehicles are much greater.

Claim History:Your past behavior as a driver matters. If you have a history of making frequent car insurance claims, especially for accidents, your insurer might increase your excess. This is because a history of claims suggests a higher future risk.

Policy Choices:The voluntary excess level you chose when you bought your car insurance policy has a direct impact. As discussed before, choosing a higher voluntary excess means a higher out-of-pocket payment when you claim.

Cover Type Specifics:Some comprehensive car insurance policies have special excess amounts for specific types of claims or situations. It's important to read your policy terms carefully for these:

Windscreen Excess:Many policies have a separate, often lower, excess just for windscreen repairs or replacements.

Theft Excess:If your car is stolen, there might be a specific excess amount that applies only to theft claims.

Named Driver Excess:Sometimes, if a younger or less experienced driver listed on your policy is driving when an accident happens, a higher excess might apply.

High-Risk Regions:In some policies, driving or parking your car in certain areas known for higher risks might come with an increased excess. This is common in regions with higher accident or theft rates.

Managing Your Excess:Key Considerations

Choosing the right car insurance excess is a crucial decision. It can help you save on your car insurance premiums, but also impact your finances if you need to make a claim. Here are some key things to consider when deciding on your excess level:

Affordability is Key:Before picking a voluntary excess, think about how much money you could comfortably pay if your car got damaged today. While a higher excess can lower your monthly car insurance payments (premiums), it could lead to serious financial problems if you have an accident and cannot afford the large excess. For example, agreeing to a AED 5,000 / SAR 5,000 excess might seem good for saving AED 500 / SAR 500 a year on your premium, but can you really afford a AED 5,000 / SAR 5,000 payment out of nowhere?

Look for Discount Offers:Insurance companies want to attract customers. Sometimes, they will offer special discounts or better deals on your car insurance policy if you agree to a higher voluntary excess. Always ask about these options and weigh them against your ability to pay.

Consider Excess Protection:Some insurance providers offer an additional cover called "excess protection" or "excess waiver" for an extra fee. This add-on means that if you make a claim, your excess payment might be refunded to you. It's like paying a small amount upfront to avoid a larger payment later. Read the policy terms carefully to understand when and how this protection applies to your vehicle damage claims.

Compare the Total Cost:When you are shopping for car insurance policies, do not just look at the lowest premium. Always compare the total cost, which includes both the annual premium and the potential excess you would have to pay. A policy with a very cheap premium might have a very high excess, making it expensive in the long run if you ever need to claim. Also, check what repair costs are covered.

FAQ

Here are some common questions people ask about car insurance excess:

Q:Can I avoid paying car insurance excess?

A:In most cases, no, you cannot completely avoid paying your car insurance excess. It's a standard part of nearly all car insurance contracts when you make a claim for damage to your own vehicle. For any claim relating to accidental damage coverage on your private car, you are expected to pay this agreed-upon amount first. However, some special add-ons, like "excess protection" (as mentioned above), might allow you to get your excess payment refunded after a valid claim, but this usually comes at an extra cost on your annual premium. It's a key part of how your car insurance works.

Q:Will I pay excess if someone else claims against my policy?

A:Generally, no, you will not pay an excess if someone else claims against your car insurance policy. Your personal excess applies when you make a claim for damage to your own car. For example, if you are at fault in an accident and damage another person's vehicle, their damages are usually covered under the 'third-party liability' section of your policy. In these cases, you typically do not pay an excess. However, it's very important to know that being at fault in an accident and having a claim made against you can still impact your future car insurance premiums, often leading to an increase.

Q:Do I pay excess for windscreen repairs?

A:This definitely depends on the specific terms of your car insurance policy. Many comprehensive car insurance plans offer special windscreen cover. This often comes with a much lower excess amount, sometimes called a "windscreen excess," which could be a small fixed fee (e.g., AED 100 / SAR 100). In some cases, insurers might even offer zero excess for windscreen repairs, meaning you pay nothing out of pocket. This is different from your standard excess for major accident damage. Always check the fine print in your policy terms and conditions to understand exactly what applies to windscreen damage. It's one of those specific cover types where the rules can vary.

Read More:

How to Replace Your VW Tiguan Car Key Battery in 5 Minutes

Where Is the Volkswagen Tiguan Built? A Global Journey

How to Reset Oil Change Light on Volkswagen Tiguan 2018:Quick & Easy